April 30, 2018

We are excited to announce the successful launch of Sajida Uganda Microfinance on June 12, 2024. Sajida Uganda is now operational across two branches in Uganda: Jinja and Iganga. This milestone reflects the relentless dedication and hard work of our teams, marking another significant achievement in the expansion of MicroFin360NEXT.

With this successful deployment, Sajida Uganda can now offer its clients seamless digital financial services, including mobile-based loan and savings transactions, empowering them to manage their finances more efficiently. This launch further solidifies our commitment to driving financial inclusion in underserved regions through innovative technology solutions.

April 1, 2018

“DataSoft Systems Bangladesh Limited” and “Dushtho Paribar Unnayan Sangstha”, have signed a contract today to work jointly in Microcredit Branch Automation process. Microfin360Next is our web-based, dash-board driven Micro-Finance Management software specially developed for the Microfinance Institutes to automate their work-flow. The solution comes with an immense capability of synchronizing real time data, management level monitoring and centralized financial report consolidation. By means of adopting the solution, every aspect of microfinance business would readily be performed with secured transactional data entry which needs less effort and human touch. The solution also runs in compliance with Regulatory Authorities, Patrons, Partners, Donors and Funding Organizations. Microfinance organizations can avail this solution integrated with Management Information System (MIS), Financial Information System (FIS) and Human Resource (HR) modules.

Throughout the last decade of Microfin360Next’s successful journey it has already facilitated hundreds of Microfinance Institutions upon ensuring them a successful automation both from home and abroad. Till date DataSoft has signed One Hundred and Seventeen (117) MFI’s and has covered 4,877 of their branches so far.

POPI, a nationwide Microcredit organization and DataSoft closed an agreement on 11/12/2017 with a view to working together to implement Microfin360 SMS alert service.

As per the scope of the agreement, high officials of this organization along the large number of borrowers will get the every possible information of daily transactions through cellular SMS.

Mr. Murshed Alam Sarker, Executive Director of POPI expects upon successful implementation of this service organization’s activity will become more dynamic and modernized. Currently this organization is running their activity all over the country with 186 branches. It has become a beneficiary of using DataSoft’s Microfin360 and HR software.

As a technology partner of POPI we wish it’s every success.

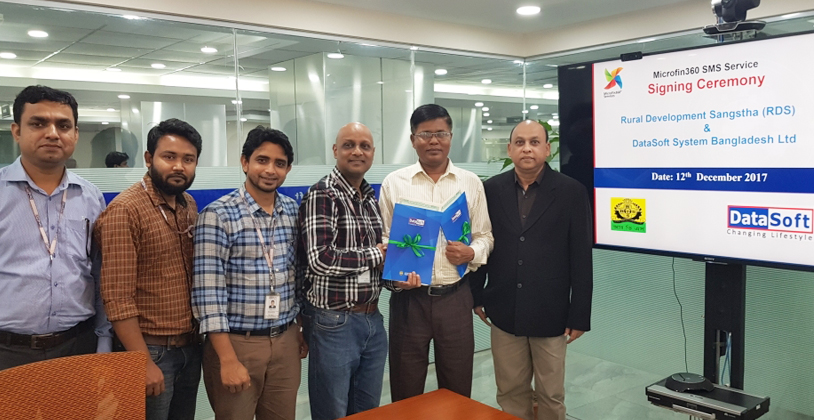

Rural Development Sangstha (RDS), and DataSoft signed an agreement on 12/12/2017 with a view to working together to implement Microfin360 SMS alert service. Mobile SMS service which is an intelligent real-time notification alert service is a recent inclusion into Microfin360, which offers organizations’ top management to get overall organization’s update through cellular SMS also helps borrowers to get an update about their loan/savings activities through the same technology.

DataSoft’s Director and COO Mr. Manjur Mahmud and Md. Noru Uddin, Executive Director signed the agreement from both side.Currently this organization is running their activity all over the country with 19 branches.

Micorifn360 has always been aspiring for incorporating innovative features to keep it’s beneficiaries capable of going with the trends of technology. To this continuation, Microfin360 development team has recently incorporated finger print assessment system on loan disbursement. Typically in rural areas MFIs suffer from risky loan disbursement especially when people receive loan with the name of others leaving minimum evidences to trace the occurrence later on. However, the circumstance has been taken into consideration by team which gives birth of this most awaited feature for Microfin360. According to Microfin360 business analyst, by using the most advanced pattern recognition and image processing technology this finger print assessment system would ensure above 99% risk free loan disbursement.

Only the banked people those are solvent enough will have some card (credit/debit) facility from bank, time has come to prove this old idea wrong. Now microfin360 offers smart card for its beneficiaries who are valid for any transaction both in ATMs and POS machines. Besides the card carries all the biometric information of particular member in a magnetic chip which is essential for unique borrower identification. During the entire loan tenure the card preserves all transactional information with dates and times. This innovation will help the crowd enjoying modern banking facilities without being a client with any of them.

March 16, 2014

As part of our effort to take our product “Microfin360Next” in the global stage, it our privileged to inform you Microfin360Next operations are spread in Indonesia through a local partner “Gamatechno” – one of leading ICT companies in Indonesia. Gamatechno shall promote and support the product in Indonesia.

In this connection at Cebit 2014 , in Hanover Germany ,there has been a signing ceremony ,Muhammad Aditya A.N. President Director , Gamatechno and M Manjur Mahmud , Director and COO, DataSoft signed on behalf of the respective companies . Among others Arif Havas Oegroseno, Ambassador to Belgium, Luxemburg and the EU Embassy of Indonesia and Andreas Gruchow, member of the board Deutsche Messe has graced the occasion .

May 26, 2013

http://www.prothom-alo.com/detail/date/2013-05-14/news/352118

http://www.ejugantor.com/2013/05/20/13/details/13_r2_c2.jpg

http://www.theindependentdigital.com/index.php?opt=view&page=14&date=2012-11-14

http://www.thedailystar.net/beta2/news/a-complete-business-solution/

http://www.microfinancegateway.org/p/site/m/template.rc/1.11.190407/

October 7, 2012

We are pleased to inform you that Today (7th October, 2012) DataSoft Systems Bangladesh Limited and Dwip Unnayan Songstha, Hatia has signed the contract to work jointly in automation process for DWIP. Dwip Unnayan Songstha has 17 branches in total with Head Office where all branches will be brought under Microfin360Next services by DataSoft.

Mr. Md. Rafiqul Alam, Executive Director of DWIP and Ms. Dil Afroz Begum, Director (HR & Finance) of DataSoft signed the contract from each party. Till now DataSoft has signed 28 MFI’s.

September 17, 2012

IIn collaboration with Citycell, DataSoft has done pilot with High Gain Antenna on 13th September, 2012 at Chorfashion, Bhola. Two senior personnel from DataSoft have been there to conduct this event and came up with successful outcome. Our parters FDA and GJUS are satisfied enough to roll out this technique at their remote branches with limited or no connectivity. High gain antenna can be build up from local electrical shop. Specification will be provided upon request.

Earlier, connectivity issue was a challenge to implement web-based services at field level. With this initiative DataSoft could overcome this and ensures better online connectivity for better operation.

Contributors from our partners:

- Mr. Farid Hossain from FDA

- Mr. Jahirul Haque from FDA

- Mr. Shonkor Chandra Debnath from FDA

- Mr. Jahid from GJUS

- Mr. Forkan Mia from GJUS

September 05, 2012

Ittefaq published an article on Microfin services today. It says about services and working procedures to make this application a world class standard. Mr. Manjur Mahmud, CEO of DataSoft has shared the vision where DataSoft wants to take Microfin to.

August 27, 2012

Based on implementation experience of 19 branches in 2 phases, DESHA has come forward to migrate 15 new branches with September closing balance. Strong and dedicated automation team, proper training and monitoring is noticeable there. Automation team is led by-

- Md. Belal Azam (Asst. Director)

August 14, 2012

PMK showed their tremendous effort in automation with migrating 14 branches in just 2 weeks. Automation team members of PMK must take this credit. Their effective management policy brings this scenario as an example to others. It is noted that all 14 branches were migrated with newly employed data entry operators. Dedication is the key here for their achievement. So far PMK has completed 49 branches. Special thanks goes to

- Md. Nurul Islam Pramanik, Director

- S. M. Nurul Islam (Tony), Senior Manager (IT)

- Mohammad Shofiqul Islam, Senior Manager (IT)

August 14, 2012

GBK is moving to 100% automated MFI milestone at a regular pace without experiencing fail over so far. They have just passed their 3rd phase of implementation with 5 branches which brings total 17 out of 41. Having a plan for each months and following it makes their move smooth and effective. Recruiting dedicated data entry operators is a ongoing process for them until they ended up with all branches. Credit goes to

- Md. Abul Kalam Azaz, Asst. Director (audit) and his team

August 14, 2012

DABI and New Era Foundation has kicked off automation last month with 4 and 6 branches respectively. Decent data entry speed and management concentration helps them to complete migration process in time. Microfin360Next application is found fully aligned with their requirements. PKSF representative had a visit to DABI last month and placed few feedback which has been dealt and incorporated with application.