Welcome to MicroFin360Next !

Since 2008, MicroFin360Next has been a driving force in transforming microfinance institutions (MFIs) by offering a user-friendly, web-based software solution. MicroFin360Next is a secure and cloud-based Software-as-a-Service (SaaS) solution which empowers MFIs with automated workflows, synchronized real-time data, streamlined reporting system, data security and uninterrupted connectivity. MicroFin360Next offers a modular design allowing seamless integration with back-office management systems, facilitating a truly customizable and adaptable solution for each MFI's specific needs. MicroFin360Next ensures seamless operation by adhering to the regulations and guidelines set forth by regulatory authorities, patrons, partners, donors, and funding organizations. MicroFin360Next is integrated with MIS, FIS, HR modules, eKYC, Mobile app, Digital Passbook, Audit360Next, SMS service and Ticketing system, streamlining data management and fostering operational efficiency.

Throughout the last decade of MicroFin360Next’s successful journey it has already facilitated over three hundreds of MFIs upon ensuring them a successful automation both from home and abroad.

Our Services

Cloud Hosted Services

A world class cloud infrastructure has been introduce to meet the growing computing demand.Safer in the Cloud

It delivers exceptional flexibility and scalability, enhancing efficiency and reducing costs.Mobile Apps

Mobile Apps boost user engagement and drive business growth. Making it more conveinient.Boost Efficiency with Mobile Apps

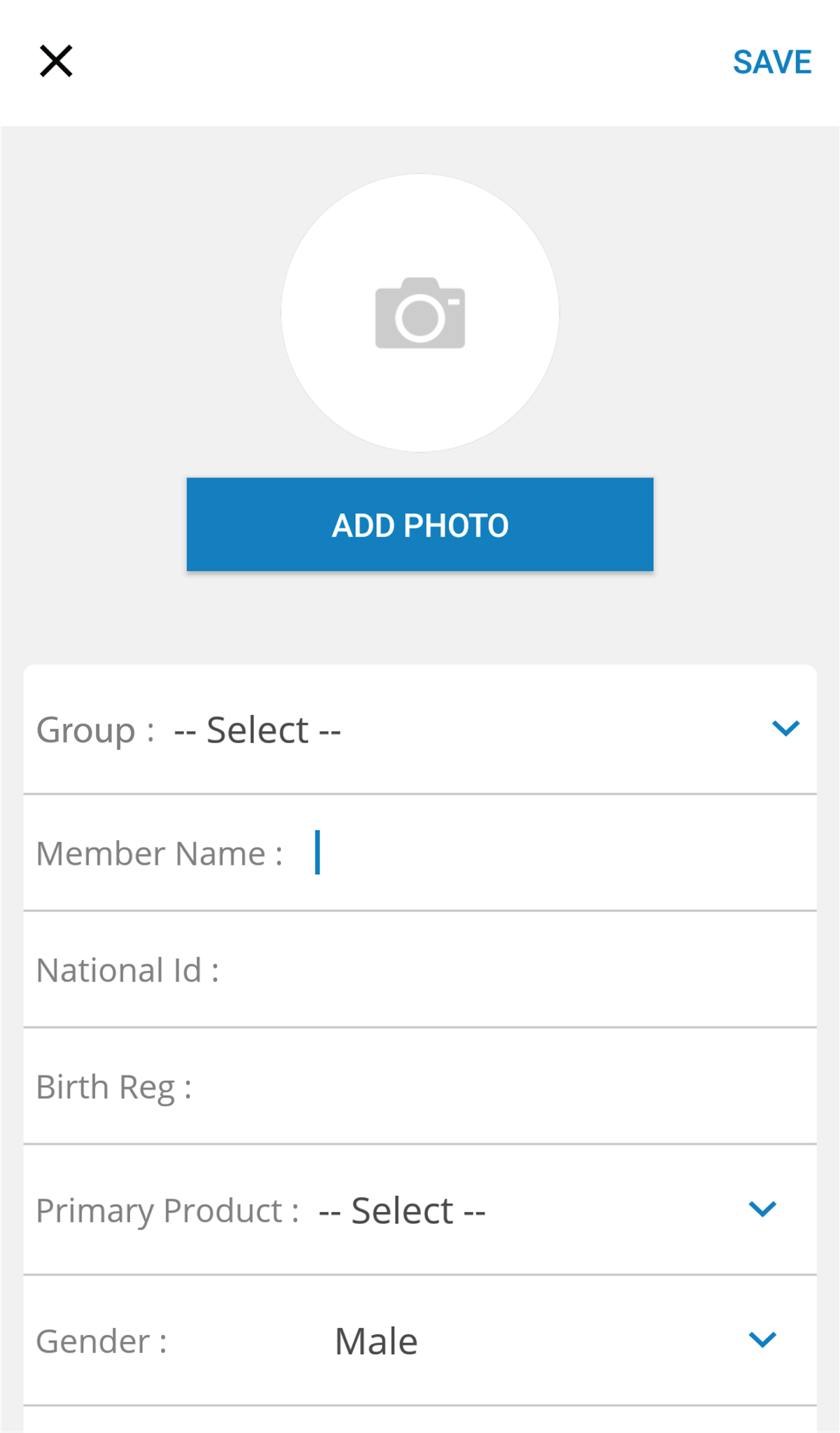

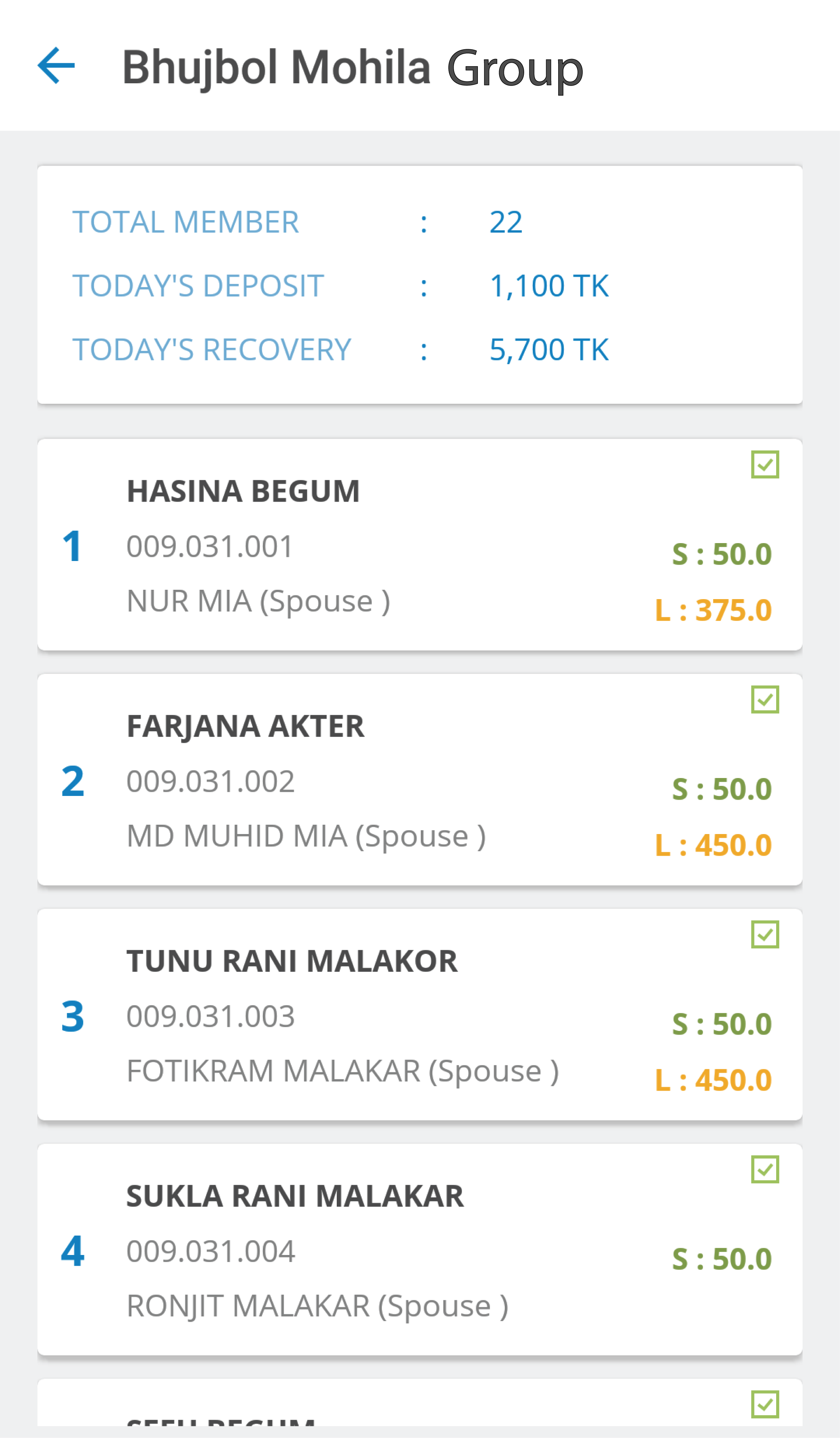

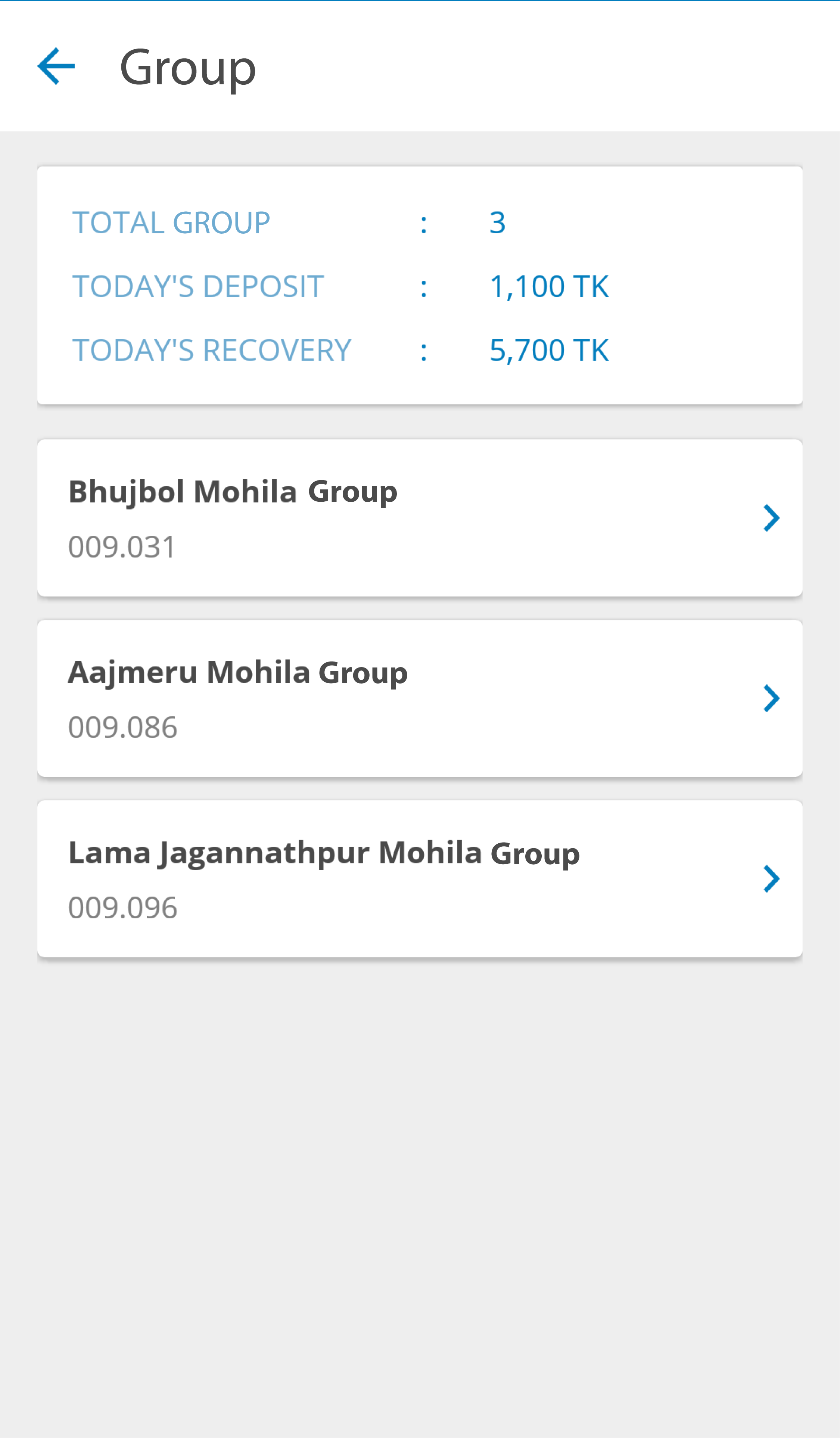

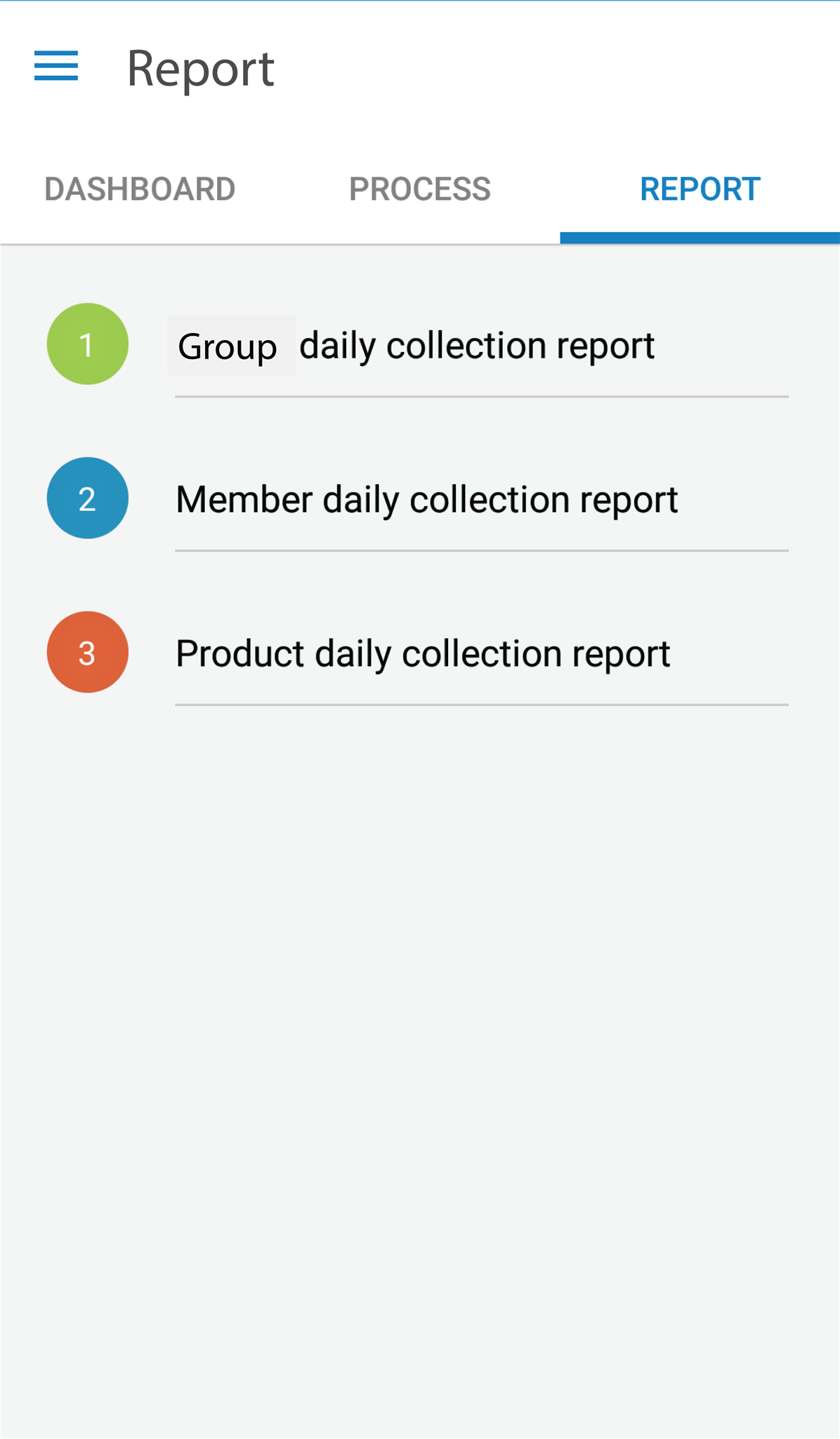

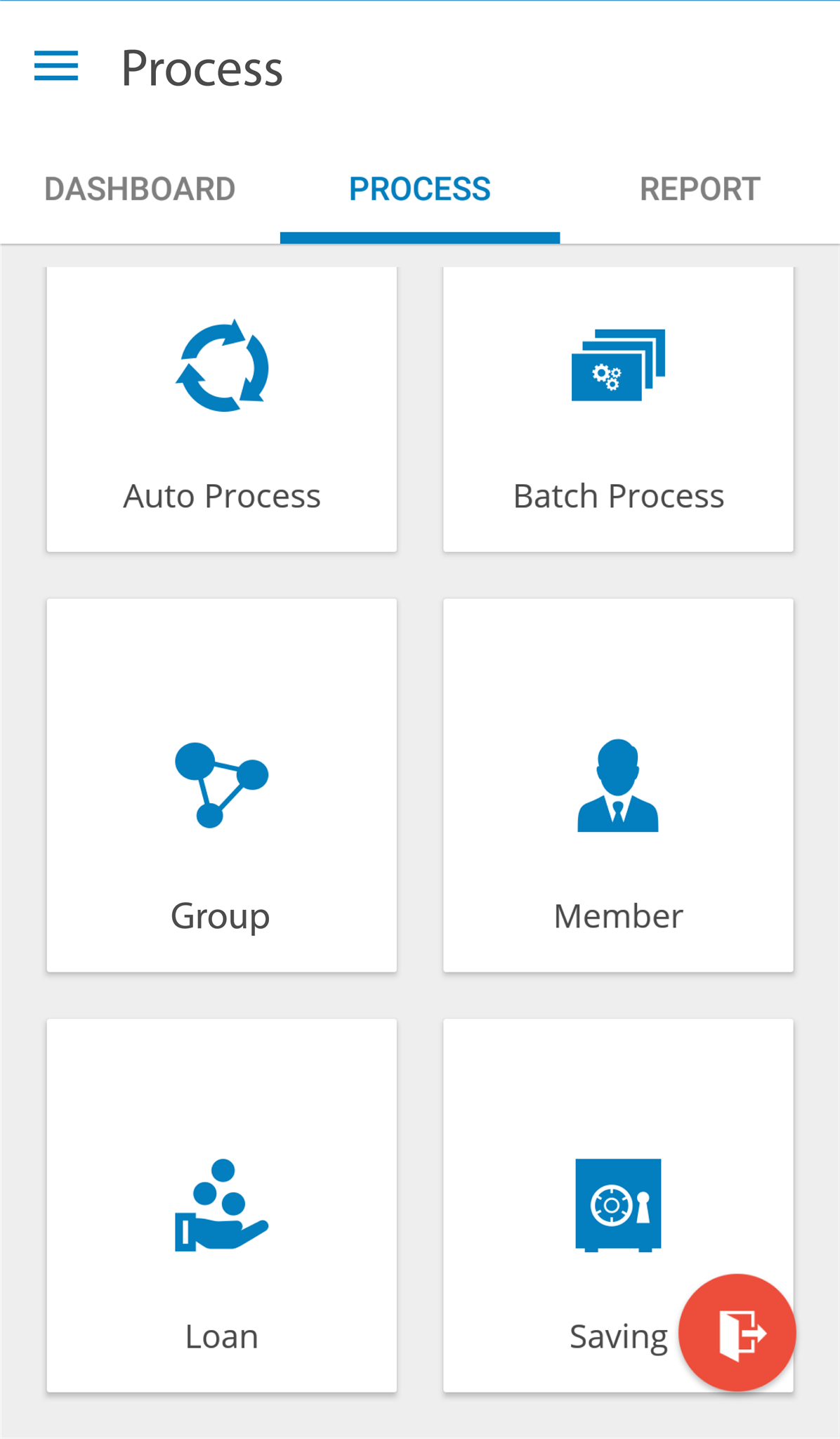

Management & FO Apps, Beneficiaries App, E-KYC.

Integrated Services

Tailored and Adaptable Solution. Seamless Integration with Back-Office ManagementTailored to users need

Integrated Services: Connect back-office functions seamlessly for efficient management. Tailored and Adaptable Solution: Customize ERP, audit, issue tracking, and e-document tools to fit your needs.

24 X 7 Support

The 24x7 Support Center is designed to provide you with support for issues encountered in your daily operation.Scalable Infrastructure

Round-the-Clock Assistance: We provide 24/7 support to ensure your operations run smoothly.

Major Features

-

Fully real time web based solution. No separate data synchronization is needed

-

Well implemented cashless branch system with better security and electronic transactions

-

Availability of Microfin360 inspired smart card for unique borrower identification and flawless transaction

-

Users are able to process and manage data at the institutional level, both at central offices and in remote locations

-

No need to invest on costly data centers. The entire application is hosted in our lightening fast and secure data center

-

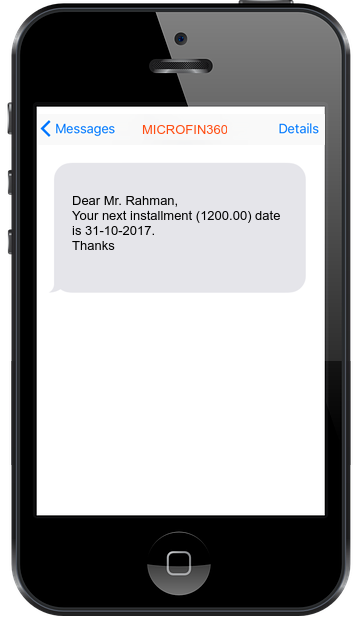

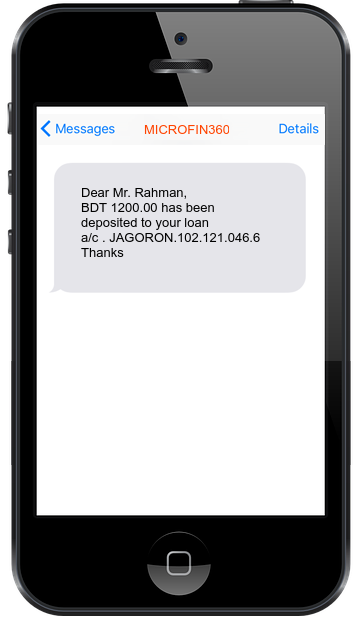

Integrated push-pull SMS notification service enabled both for management and borrowers

-

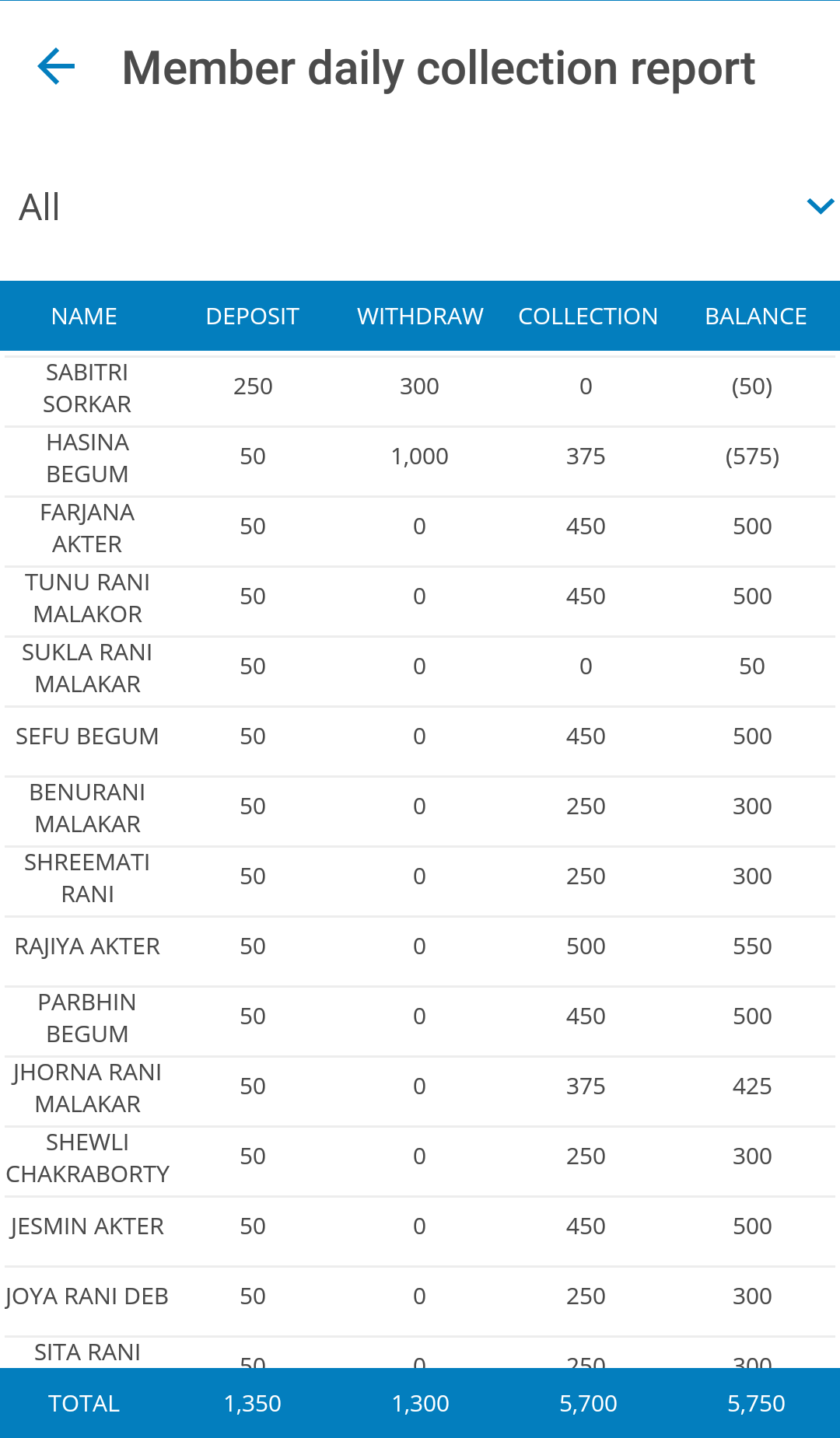

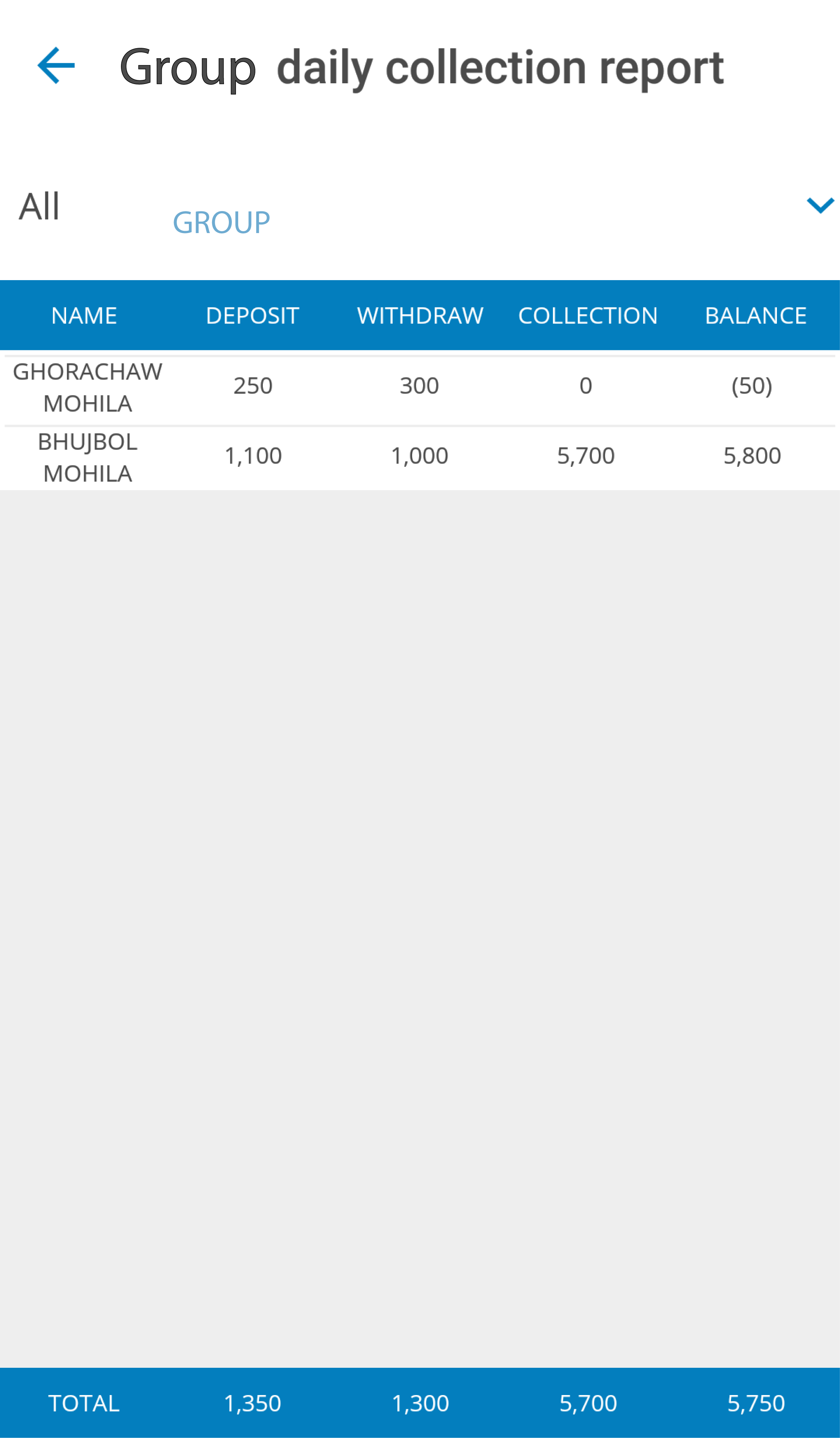

Completely paperless collection is enabled through android app

-

Reduce processing time by 200%

-

Improve overall organizational efficiency and profitability

-

Easy and faster migration process with fail-over mechanism

-

Remote access to get information anytime anywhere

-

Mobile/Tab friendly application

-

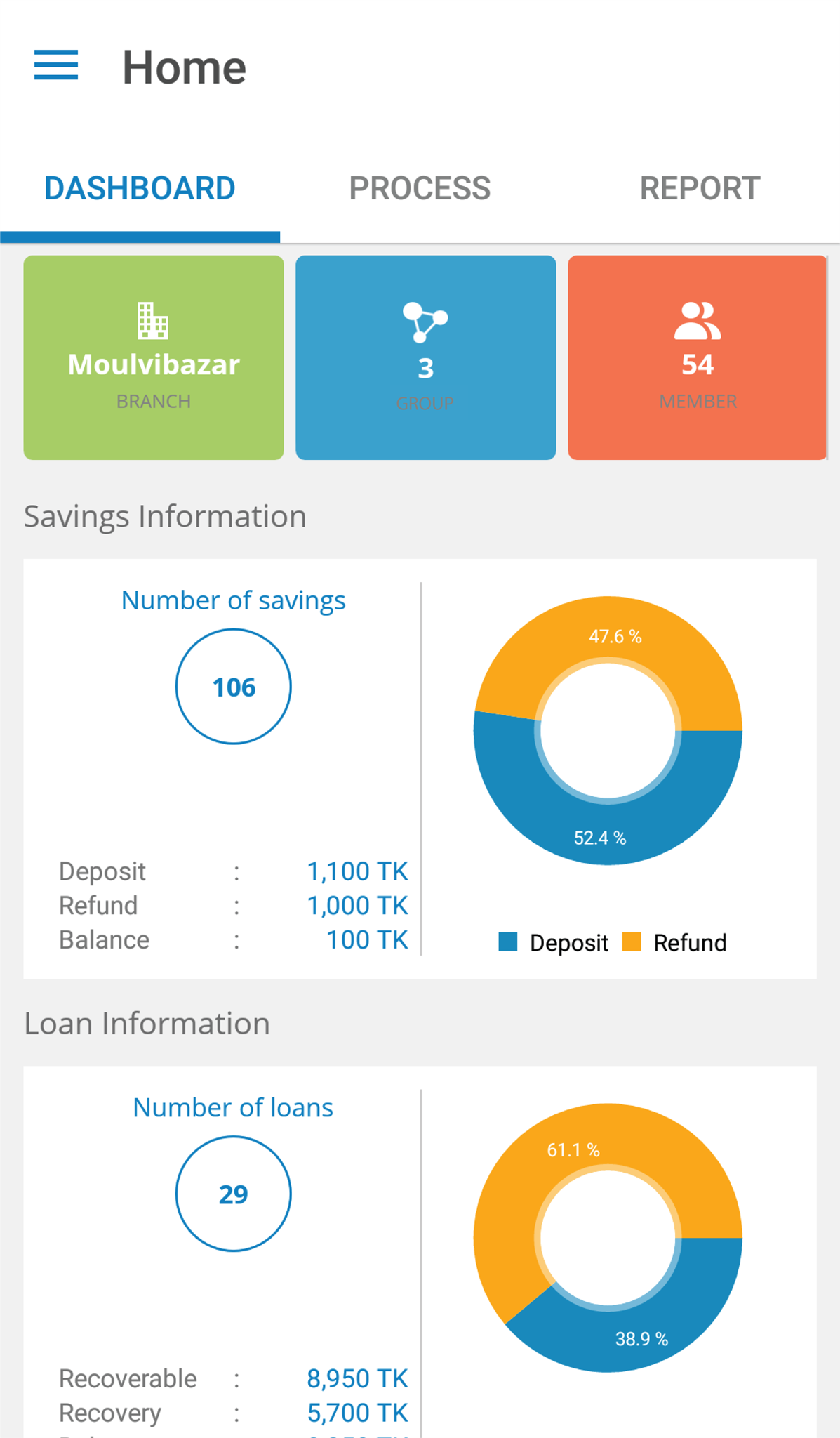

Dash-board driven information of MFI and all its branches

-

Easy and centralized administration

-

Auto ID configuration for Branch, group/center, member/borrower, loan and savings/deposits, employee, vouchers

-

Funding Organization & Regulatory Authority compliant reports

-

Track financial transactions and create reports for management, donors, and regulators

-

Become more systematic in their operating procedures in order to handle a much larger volume of information

-

Establish transparency and good governess

-

More than 200 parameterized daily, weekly, monthly and date range wise reports and registers

-

Low bandwidth friendly – suitable for remote places using cellular networks

-

Integrated core modules:

-

Management Information System (MIS)

-

Accounting Information System (AIS)

-

Human Resource Management (HRM)

-

Define unlimited number of loan product types with customizable repayment behavior

-

Instant SMS notification on Loan disbursement and Loan Transaction

-

Identification of good and bad loanee

-

Interest calculations:

-

Flat

-

Declining balance – equal monthly installments (EMI)

-

Declining balance – equal principal installments

-

Declining balance – Index Based

-

Loan-wise predefined schedule preparing

-

Target set and achievement analysis based on loan activity

-

Ability to schedule loan disbursals and repayments independent of meeting schedules

-

Loan defaults based on previous loan amounts or cycle

-

Define grace periods for loan repayments

-

Support for periodic fees, fees deducted at disbursement, one-time fees, and penalty charges

-

Support for early & partial loan repayments with rebate facility

-

Display of loan repayment schedules and detail loan account activity pages

-

Automatic update of repayment schedule if client/group’s meeting day changes

-

Variable loan installments and Support for adjustments

-

Support for adjustments

-

Allows loan write off

-

Automatically change loan account state

-

Repay total loan at any point in loan cycle

-

Add notes to loan records

-

Support for loan rescheduling

-

Support for back-dated payments with automatic voucher update

-

Ability to generate voucher and receipts directly from loan account page

-

Allows loan waiver for death member

-

Allows loan write off

-

Dashboard driven module that provides information of MFI/individual branches

-

Auto voucher code configuration

-

Search voucher by prefix/suffix/transaction date etc.

-

All MIS financial transactions triggers auto accounting vouchers

-

System allows manual vouchers for regular expenditures and other operations

-

Fund transfer among branches

-

Supports budget/budget variance

-

Dashboard driven module that provides information of MFI/individual branches

-

Auto voucher code configuration

-

Search voucher by prefix/suffix/transaction date etc.

-

All MIS financial transactions triggers auto accounting vouchers

-

System allows manual vouchers for regular expenditures and other operations

-

Fund transfer among branches

-

Supports budget/budget variance

-

Supports dig down report to get track of transactions

-

Prevents unauthorized back dated data entry

-

Supports up to unlimited depth level in chart of accounts

-

Supports donor loan management and scheduling

-

Supports all the major financial reports like:

-

Trial Balance

-

Receipt-Payment Statement

-

Income Statement

-

Balance Sheet

-

Cash flow statement

-

Ledger reports

-

Daily Transactions

-

Bank and Cash Book

-

Fund transfer

-

Subsidiary ledger report

-

Notes to balance sheet

-

and more..

-

Apply and approve leave on-line with notification to listed users

-

Support for earn leave management

-

Employee can give entry of his timekeeping data

-

Support for Bangla and English. Easy to localize to other languages

-

Ability to specify all install-time configurations

-

User-interface to configure system configurations

-

Specify supported payment types (cash, voucher, checks)

-

Define unlimited custom fields for client, group, center, accounts and system users

-

Ability to schedule holidays and loan moratoriums (office and branch-wise) and have loan, savings, and fee schedules automatically updated

Latest News

June 12, 2024

We are excited to announce the successful launch of Sajida Uganda Microfinance on June 12, 2024. Sajida Uganda is now operational across two branches in Uganda: Jinja and Iganga. This milestone reflects the relentless dedication and hard work of our teams, marking another significant achievement in the expansion of MicroFin360NEXT.

With this successful deployment, Sajida Uganda can now offer its clients seamless digital financial services, including mobile-based loan and savings transactions, empowering them to manage their finances more efficiently. This launch further solidifies our commitment to driving financial inclusion in underserved regions through innovative technology solutions.

May 15, 2024

“DataSoft Systems Bangladesh Limited” and “Dushtho Paribar Unnayan Sangstha”, have signed a contract today to work jointly in Microcredit Branch Automation process. Microfin360Next is our web-based, dash-board driven Micro-Finance Management software specially developed for the Microfinance Institutes to automate their work-flow. The solution comes with an immense capability of synchronizing real time data, management level monitoring and centralized financial report consolidation. By means of adopting the solution, every aspect of microfinance business would readily be performed with secured transactional data entry which needs less effort and human touch. The solution also runs in compliance with Regulatory Authorities, Patrons, Partners, Donors and Funding Organizations. Microfinance organizations can avail this solution integrated with Management Information System (MIS), Financial Information System (FIS) and Human Resource (HR) modules.

Throughout the last decade of Microfin360Next’s successful journey it has already facilitated hundreds of Microfinance Institutions upon ensuring them a successful automation both from home and abroad. Till date DataSoft has signed One Hundred and Seventeen (117) MFI’s and has covered 4,877 of their branches so far.

POPI, a nationwide Microcredit organization and DataSoft closed an agreement on 11/12/2017 with a view to working together to implement Microfin360 SMS alert service.

As per the scope of the agreement, high officials of this organization along the large number of borrowers will get the every possible information of daily transactions through cellular SMS.

Mr. Murshed Alam Sarker, Executive Director of POPI expects upon successful implementation of this service organization’s activity will become more dynamic and modernized. Currently this organization is running their activity all over the country with 186 branches. It has become a beneficiary of using DataSoft’s Microfin360 and HR software.

As a technology partner of POPI we wish it’s every success.

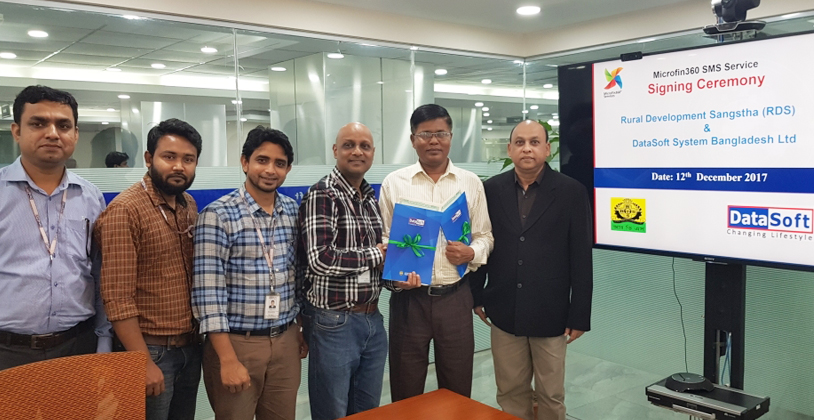

Rural Development Sangstha (RDS), and DataSoft signed an agreement on 12/12/2017 with a view to working together to implement Microfin360 SMS alert service. Mobile SMS service which is an intelligent real-time notification alert service is a recent inclusion into Microfin360, which offers organizations’ top management to get overall organization’s update through cellular SMS also helps borrowers to get an update about their loan/savings activities through the same technology.

DataSoft’s Director and COO Mr. Manjur Mahmud and Md. Noru Uddin, Executive Director signed the agreement from both side.Currently this organization is running their activity all over the country with 19 branches.

Micorifn360 has always been aspiring for incorporating innovative features to keep it’s beneficiaries capable of going with the trends of technology. To this continuation, Microfin360 development team has recently incorporated finger print assessment system on loan disbursement. Typically in rural areas MFIs suffer from risky loan disbursement especially when people receive loan with the name of others leaving minimum evidences to trace the occurrence later on. However, the circumstance has been taken into consideration by team which gives birth of this most awaited feature for Microfin360. According to Microfin360 business analyst, by using the most advanced pattern recognition and image processing technology this finger print assessment system would ensure above 99% risk free loan disbursement.

Only the banked people those are solvent enough will have some card (credit/debit) facility from bank, time has come to prove this old idea wrong. Now microfin360 offers smart card for its beneficiaries who are valid for any transaction both in ATMs and POS machines. Besides the card carries all the biometric information of particular member in a magnetic chip which is essential for unique borrower identification. During the entire loan tenure the card preserves all transactional information with dates and times. This innovation will help the crowd enjoying modern banking facilities without being a client with any of them.

March 16, 2014

As part of our effort to take our product “Microfin360Next” in the global stage, it our privileged to inform you Microfin360Next operations are spread in Indonesia through a local partner “Gamatechno” – one of leading ICT companies in Indonesia. Gamatechno shall promote and support the product in Indonesia.

In this connection at Cebit 2014 , in Hanover Germany ,there has been a signing ceremony ,Muhammad Aditya A.N. President Director , Gamatechno and M Manjur Mahmud , Director and COO, DataSoft signed on behalf of the respective companies . Among others Arif Havas Oegroseno, Ambassador to Belgium, Luxemburg and the EU Embassy of Indonesia and Andreas Gruchow, member of the board Deutsche Messe has graced the occasion .

May 26, 2013

http://www.prothom-alo.com/detail/date/2013-05-14/news/352118

http://www.ejugantor.com/2013/05/20/13/details/13_r2_c2.jpg

http://www.theindependentdigital.com/index.php?opt=view&page=14&date=2012-11-14

http://www.thedailystar.net/beta2/news/a-complete-business-solution/

http://www.microfinancegateway.org/p/site/m/template.rc/1.11.190407/

October 7, 2012

We are pleased to inform you that Today (7th October, 2012) DataSoft Systems Bangladesh Limited and Dwip Unnayan Songstha, Hatia has signed the contract to work jointly in automation process for DWIP. Dwip Unnayan Songstha has 17 branches in total with Head Office where all branches will be brought under Microfin360Next services by DataSoft.

Mr. Md. Rafiqul Alam, Executive Director of DWIP and Ms. Dil Afroz Begum, Director (HR & Finance) of DataSoft signed the contract from each party. Till now DataSoft has signed 28 MFI’s.

September 17, 2012

In collaboration with Citycell, DataSoft has done pilot with High Gain Antenna on 13th September, 2012 at Chorfashion, Bhola. Two senior personnel from DataSoft have been there to conduct this event and came up with successful outcome. Our parters FDA and GJUS are satisfied enough to roll out this technique at their remote branches with limited or no connectivity. High gain antenna can be build up from local electrical shop. Specification will be provided upon request.

Earlier, connectivity issue was a challenge to implement web-based services at field level. With this initiative DataSoft could overcome this and ensures better online connectivity for better operation. << /p>

Contributors from our partners: << /p>

- Mr. Farid Hossain from FDA

- Mr. Jahirul Haque from FDA

- Mr. Shonkor Chandra Debnath from FDA

- Mr. Jahid from GJUS

- Mr. Forkan Mia from GJUS

September 05, 2012

Ittefaq published an article on Microfin services today. It says about services and working procedures to make this application a world class standard. Mr. Manjur Mahmud, CEO of DataSoft has shared the vision where DataSoft wants to take Microfin to.

August 27, 2012

Based on implementation experience of 19 branches in 2 phases, DESHA has come forward to migrate 15 new branches with September closing balance. Strong and dedicated automation team, proper training and monitoring is noticeable there. Automation team is led by-

- Md. Belal Azam (Asst. Director)

August 14, 2012

PMK showed their tremendous effort in automation with migrating 14 branches in just 2 weeks. Automation team members of PMK must take this credit. Their effective management policy brings this scenario as an example to others. It is noted that all 14 branches were migrated with newly employed data entry operators. Dedication is the key here for their achievement. So far PMK has completed 49 branches. Special thanks goes to

- Md. Nurul Islam Pramanik, Director

- S. M. Nurul Islam (Tony), Senior Manager (IT)

- Mohammad Shofiqul Islam, Senior Manager (IT)

August 14, 2012

GBK is moving to 100% automated MFI milestone at a regular pace without experiencing fail over so far. They have just passed their 3rd phase of implementation with 5 branches which brings total 17 out of 41. Having a plan for each months and following it makes their move smooth and effective. Recruiting dedicated data entry operators is a ongoing process for them until they ended up with all branches. Credit goes to

- Md. Abul Kalam Azaz, Asst. Director (audit) and his team

August 14, 2012

DABI and New Era Foundation has kicked off automation last month with 4 and 6 branches respectively. Decent data entry speed and management concentration helps them to complete migration process in time. Microfin360Next application is found fully aligned with their requirements. PKSF representative had a visit to DABI last month and placed few feedback which has been dealt and incorporated with application.

Why Choose Us ?

-

Integrated MIS, AIS, and Back Office Solutions: Designed specifically for MFIs institutions.

-

Advanced Management Dashboard: Access statistical insights for effective decision-making.

-

Compliance Assurance: Tailored solutions to meet the requirements of regulatory authorities.

-

Centralized Operations: Streamlined processes for improved operational efficiency.

-

Low Bandwidth Capability: Optimized for remote users, functioning even on cellular connections.

-

Top-Tier Data Security: Ensure a world-class data center with a disaster recovery site.

-

Training and Support: Comprehensive training and ongoing support to ensure seamless operations.

Our Partners

-

TMSS

-

Society for Social Service (SSS), Tangail

-

People’s Oriented Program Implementation (POPI) , Dhaka

-

Palli Mongal Karmosuchi (PMK), Ashulia, Dhaka

-

Centre for Development Innovation & Practices (CDIP), Dhaka

-

DESHA, Kushtia

-

Manabik Shahajya Sangstha (MSS), Dhaka

-

ESDO

-

HEED Bangladesh

-

Muslim Aid Serving Humanity

-

ASHRAI

-

CODEC

-

Center for Community Development Assistance (CCDA), Comilla

-

SEBA

-

Bangladesh Association for Social Advancement (BASA), Dhaka

-

SETU, Kushtia

-

Page Development Center, Comilla

-

Social Advancement Through Unity (SATU), Tangail

-

Pally Bikash Kendra (PBK), Kishoreganj

-

Dak Diye Jai (DDJ), Pirojpur

-

PDBF

-

Uttara Development Program Society

-

Integrated Rural Employment Support Project For the Poor Women

-

Integrated Community Development Association (ICDA), Barisal

-

KMFI

-

Grameen Jano Unnoyon Shangstha (GJUS), Bhola

-

IDF

-

SOPIRET

-

Mohila Bohumukhi Sikkha Kendra (MBSK), Dinajpur

-

BNPS

-

GUK

-

Small Farmers Development Foundation (SFDF), Dhaka

-

Somaj-o-Jati Gathan, Dhamrai

-

Centre for Action Research-Barind (CARB)

-

Social Upliftment Society (SUS), Savar

-

Paribar Unnayan Sangstha (FDA), Charfassion, Bhola

-

ARAB

-

Social Assistance and Rehabilitation for the Physically Vulnerable (SARPV)

-

Gono Kallyan Trust (GKT), Manikganj

-

ROVA

-

Shariatpur Development Society (SDS), Shariatpur

-

Development Organisation of the Rural Poor (DORP), Dhaka

-

SDI

-

Organization for Social Advancement & Cultural Activities, Pabna

-

CEDAR

-

MDO

-

Dwip Unnayan Songstha, Hatia, Noakhali (DUS)

-

Naria Unnayan Group (NUSA), Shariatpur

-

Patakuri Society, Sreemongal

-

Pabna Protisruti

-

New Era Foundation, Iswardi, Pabna

-

CARSA Foundation, Barisal

-

Action for Human Development Organization (AHDO), Kushtia

-

CREED

-

SRAS

-

ASPADA Poribash Unnayan Foundation

-

BGS

-

MSUK

-

UNNAYAN

-

Polli Sree, Dinajpur

-

Antar Society for Development, Dhaka

-

DABI Moulik Unnayan Songstha (DABI), Naogaon

-

KKS

-

Al-Falah Aam Unnayan Sangstha (AFAUS), Dinajpur

-

Palli Shishu Foundation of Bangladesh (PSF), Dhaka

-

AVA Development Society, Natore

-

Gram Bikash Kendro (GBK), Parbotipur, Dinajpur

-

Ambala Foundation

-

Bangladesh Assocation for Community Education (BACE), Dinajpur

-

VPKA Foundation

-

Bangladesh Development Society (BDS), Barisal

-

Association for Realisation of Basic Needs (ARBAN), Dhaka.

-

HARD

-

Barendrabhumi Samaj Unnayan Sangstha (BSDO)

-

NHEDS

-

MMS

-

Amra Kaj Kory (AKK), Faridpur

-

ASKS

-

FDAF

-

BOAT

-

Habiganj Unnayan Sangstha (HUS), Habiganj

-

POUS

-

Shiropa Development Society (SDS)

-

PPS

-

Proshikhan Karmasangsthan o Artha-Samajic Unnayan Sangstha, Comilla

-

Rural Health Education & Credit Organisation

-

VDF

-

Association for Socio-Economic Advancement of Bangladesh, Pabna

-

SDC

-

JDF

-

Solidarity

-

BIRD

-

Social Development Association (SDA)

-

PSS

-

MUS

-

RDS

-

Swakalpo

-

PARAPAR

-

PUS

-

Sammilon Foundation

-

SUSS

-

DFED

-

Agragati

-

GRAUK

-

PIPASA

-

RDWF

-

CLDP

-

SUSMB

-

KPSPF

-

GSS